Payment methods

From 1 July 2024 Housing Foundation will charges a general payment fee per payment, whether by bank transfer, credit or debit card or MobilePay. The fee covers the costs associated with payments via payment card and the manual handling of bank transfers and MobilePay. The payment fee is DKK 175 per payment, which means that if you make several payments on one day or subsequent days, a payment fee is charged for each payment.

When paying made by credit or debit card online, the payment fee is automatically added to the amount entered in the payment window.

When paying by bank transfers or MobilePay, the payment fee is added to your tenant’s account when the payment is registered. The payment must therefore be DKK 175 more than the amount owed.

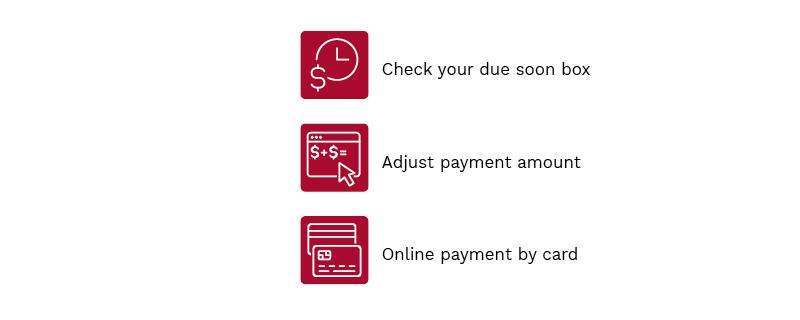

Credit or debit card

Credit or debit card payments are made via the booking system (please see the Booking Manual for the necessary steps). Usually, the best and cheapest way for you to pay is via credit card in our online system.

A service payment provider company supply the online payment option. In some rare cases, you are charged a percentage of the amount you are paying when making a payment using a credit or debit card. This amount is not paid to us, but is paid directly to the service payment provider company.

NB: It is not possible to use American Express when you make your payments.

In order for you to avoid paying fees when we are returning your deposit, it is important that you make sure your credit card is valid up to 6 months after your contract end date. The deposit will be returned to the latest used credit cards. Please have that in mind when making the last payment of your stay. Read more about deposit returns here.

Paying by card is easiest – but some credit cards will encounter extra charges

The charges for cards are automatically added to the amount you have selected to pay to the Housing Foundation whenever you are using the online payment option. The amount paid to the payment service provider. The payment service provider will not appear in your Account Status page on your flow, as it is not paid to the Housing Foundation – it will only appear in your credit card statement.

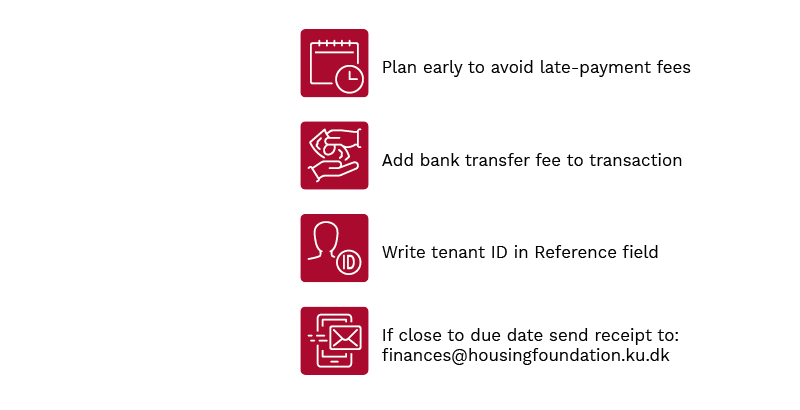

Bank Transfer

Paying via bank transfer

If you pay via bank transfer, the Housing Foundation charges a payment fee. Remember to add this fee to your payment. You can find our fee list here

To make an international bank transfer, you need to indicate our SWIFT code and IBAN number, and name the Housing Foundation as the beneficiary. You must provide your tenant ID, otherwise we can’t trace the payment to you and confirm receipt.

If we need to transfer money to you, please provided us with your SWIFT and IBAN numbers, which you can get from your bank.

Bank account details for the Housing Foundation

Bank: Danske Bank

Registration number: 4180

Account number: 10364183

IBAN: DK9530000010364183 (BIC) / SWIFT: DABADKKK

Account holder: Housing Foundation

Bank Address

Danske Bank

Erhvervscenter København

Holbergsgade 2

1057 Copenhagen K

Time frame for bank transfer

Please be aware that the transfer procedure might take several days; so make sure to do the transfer well in advance so we have the payment on time. Making an international money transfer can be costly since the involved banks often add their own extra fees. As a tenant you are responsible for taking these into account and paying these fees.

Please send a receipt in English to [email protected] if it is close to your payment due date.

Checklist: proceeding payment via bank transfer

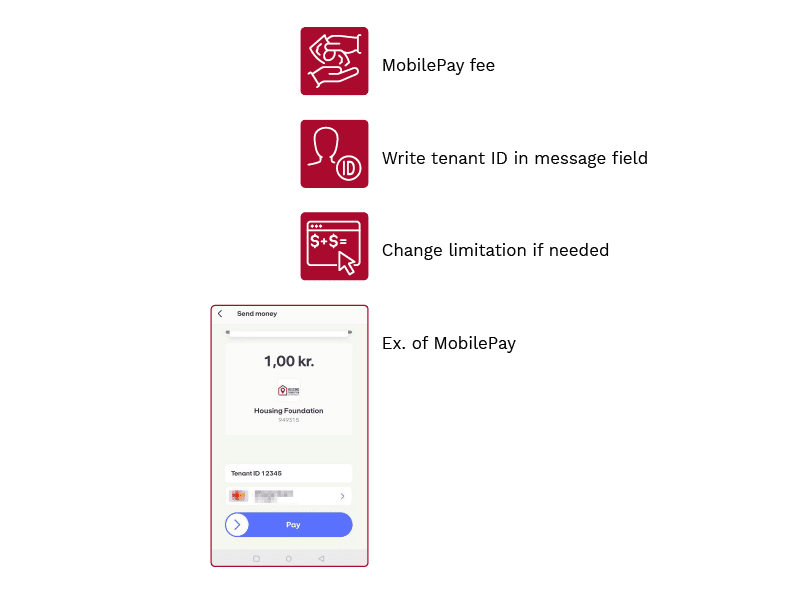

MobilePay

Payment via MobilePay is an option if you have a Danish bank account

MobilePay is an app which can be downloaded from the app store/Google play/Windows Phone store – it is free to download. You can read more about the app, which was developed by Danske Bank in 2013

How do I do it?

- Download the application “MobilePay” on your smartphone or tablet and follow the installation instructions.

- Open the app and enter the amount you wish to pay.

- Click “vælg modtager” (=”choose recipient”) and enter our number: (+45) 94 93 15.

- Enter your tenant ID (5 digit number) in the message field, so we know who sent us the money. Swipe right to transfer the money. A receipt will then appear on your screen. The receipt can always be found in your MobilePay app later, if needed.

Please check the list of fee here.

Limit on transactions when using MobilePay

As a standard setting, the transaction limit will be DKK 10.000 per day. This limit can be increased by going to settings in the app – you will need your NEM-ID to change the limit (please ask your bank for further information).

Checklist: proceeding payment via MobilePay